The lifeblood of any business is money management.

The cash flow, which is the movement of money in and out of a business, can make or break a venture. This means that learning this part of running a business is very important and that’s where “Cashflow Kung Fu” comes in handy.

Essentially, the guide will take you through all the necessary steps needed for you to become financially knowledgeable about your own establishment.

Definition of Cash Flow

Simply put, cash flow refers to how much money moves into and out of a company. On one hand, inflows are made up of sales revenues as well as investment earnings while on the other hand, outflows come in the form of salaries paid to employees or rent paid by organizations among other things like supplies used during the production process etcetera.

A positive cash flow occurs when more funds are received than spent whereas negative cash flows indicate otherwise.

Why Manage Cash Flows?

Appropriate management for cash flows enables timely payment of bills such as utilities; fosters capital investments towards expansion projects and takes care of unexpected costs therefore avoiding stress related to being broke because even profitable firms can collapse if they do not handle their financial resources properly.

Design Cash Flow Forecasting System

A projection showing estimates about what amount one expects his/her enterprise would receive or spend over a certain period called a forecast should be created. This helps us plan for surpluses as well as shortages which are likely to occur based on our predictions so far.

In order to come up with it, monthly incomes together with expenses anticipated need to be listed down and then updated regularly depending on actual performance records.

Monitor Your Cash Flows Frequently

Frequent check-ups should be done on how much comes into your company vis-a-vis what goes out; this is monitoring cash flows. It aids early detection of problems thereby taking remedial measures timeously.

Accounting software may help while keeping records using spreadsheets can be used too where these figures should be reviewed either once per week or every month.

Create a Cash Flow Forecast

A cash flow projection is an estimate of the flow of money in and out of your business over a given period. This can be used to predict when there will be too little or too much cash so that plans can be made. To do this, write down all the money you expect to receive or spend each month. Make sure you regularly adjust it with what is happening.

Here’s an example of a six-month cash flow forecast:

| Month | Expected Inflows ($) | Expected Outflows ($) | Net Cash Flow ($) |

|---|---|---|---|

| January | 10,000 | 8,000 | 2,000 |

| February | 15,000 | 9,000 | 6,000 |

| March | 12,000 | 10,000 | 2,000 |

| April | 13,000 | 9,500 | 3,500 |

| May | 16,000 | 10,500 | 5,500 |

| June | 14,000 | 11,000 | 3,000 |

This table shows the expected cash inflows and outflows for each month, helping you to visualize and manage your business’s cash flow. By forecasting cash flow, you can anticipate potential shortfalls and take steps to ensure you have enough cash on hand to cover your expenses.

Explanation of the Cash Flow Forecast Table

The Cash Flow Forecast table provides a detailed view of expected cash movements in and out of the business over a six-month period. Here’s a breakdown of the columns:

- Month: This column lists each month from January to June.

- Expected Inflows ($): This column shows the projected cash inflows, which are the funds expected to be received by the business during each month.

- Expected Outflows ($): This column displays the projected cash outflows, which are the expenses expected to be paid by the business during each month.

- Net Cash Flow ($): This column calculates the difference between inflows and outflows for each month. A positive number indicates that more cash is coming in than going out, while a negative number would indicate a deficit.

Detailed Breakdown

- January: The business expects to receive $10,000 and spend $8,000, resulting in a net cash flow of $2,000.

- February: Expected inflows are $15,000 with outflows of $9,000, leading to a net cash flow of $6,000.

- March: Inflows of $12,000 and outflows of $10,000 result in a net cash flow of $2,000.

- April: The business anticipates $13,000 in inflows and $9,500 in outflows, resulting in a net cash flow of $3,500.

- May: Inflows are expected to be $16,000 and outflows $10,500, resulting in a net cash flow of $5,500.

- June: The business expects $14,000 in inflows and $11,000 in outflows, leading to a net cash flow of $3,000.

Quicken Receivables

The velocity at which receivables turn into money determines cash flow. Below are tactics for hastening inflows:

Speedy Billing: As soon as job finishes or goods arrive send the bill promptly.

Early Payment Discounts: Give small discounts to encourage customers to pay invoices early.

Electronic Payments Integration: Make the electronic transfer payment method convenient for clients so that it becomes easy for them to pay quickly thus speeding up the collections process on your side also.

Monitor Your Cash Flow Regularly

Monitor your cash flow diligently. This is beneficial since it allows you to discover problems ahead of time and make the necessary adjustments. You can track your cash flow using accounting software or spreadsheets, and then review it either weekly or monthly.

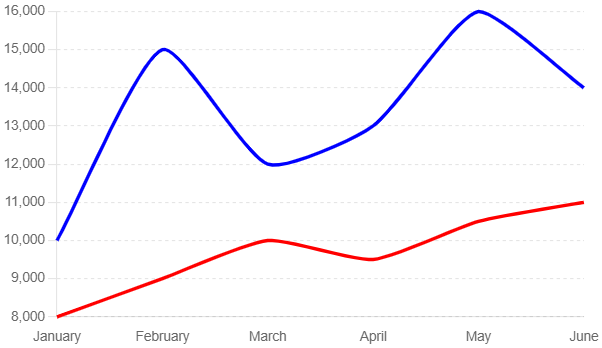

The graph below demonstrates how following up on inflows and outflows of cash for a period of six months helps in improving management:

This diagram shows the anticipated inflows (indicated by the blue line) and outflows (indicated by the red line) between January and June. Through regular monitoring of these patterns, you can easily notice the months where there might be more outflows than inflows hence finding ways to effectively handle your money.

Explanation of the Cash Flow Monitoring Graph

The Cash Flow Monitoring Graph tracks the expected cash inflows and outflows over a six-month period. It helps visualize the financial trends and identify potential issues in managing cash flow.

Key Features:

- X-Axis (Month): Represents each month from January to June.

- Y-Axis (Amount $): Represents the amount of cash in dollars.

- Blue Line (Expected Inflows): Tracks the expected cash coming into the business each month.

- Red Line (Expected Outflows): Tracks the expected cash going out of the business each month.

Control Cash Outflows

Money inflow improvement strategies should go hand in hand with methods employed to minimize outflows. Measures for achieving this objective include:

Supplier Negotiations: Enquire if there could be a longer credit period granted or get a rebate when settling invoices ahead of time.

Regular Expenditure Revision; Any expenses found not necessary should be removed from the list after identifying them each time an audit is done.

Major Acquisition Postponement; Wait until healthier times come then buy such costly assets that negatively affect your current financial position otherwise known as a “cash trap”

Reserve Some Funds

You will need a backup plan just like you would require having some savings.

This can take the form of saving at least three months’ worth of operating expenditures to cushion yourself during hard times when sales decline unexpectedly or sudden business opportunities knock.

Utilize Credit Facilities Prudently

Debt financing is good for managing temporary deficits but only if it is used the right way otherwise may lead one into financial problems due to too much borrowing therefore should have repayment plans in place before taking any loans.

Simplify Business Operations

Smooth running processes enhance cash flow greatly. The following are suggestions on how best you can do that:

Process Automation; Routine tasks ought automated using technology especially those that require human intervention thereby cutting down labor costs significantly while improving efficiency levels concurrently.

Inventory Control; Minimize stock holding without compromising the ability to meet customer demand punctually.

A Scheme to Grow

Business development can be financially challenging.

Prepare for expansion by:

Predicting Extra Charges: Valuing the additional expenses that will result from growth.

Getting Funding Secured: If necessary, ensure you have more money available before it’s needed.

Grow in Phases: Do not try everything at once so as not to overpower your cash flow.

Seek Professional Help

At times, cash management may become complicated, especially with large businesses. In such cases do not hesitate to get advice from professionals in finance. Accountants and financial advisors will give you expert opinions that can help form sound strategies for success.

Conclusion

To succeed and stay long in business, one needs to know “Cashflow Kung Fu” or rather how best they can manage their funds within the enterprise.

Ensure stability of finances and position for development by mastering the art of controlling the inflow/outflow of money into/from business undertakings.

Always keep an eye on it continuously while also planning strategically for tomorrow; whenever required seek guidance from experts who know what they are doing regarding this matter because effective management demands consistent monitoring alongside strategic planning backed up by professional input without these skills no one will ever excel at managing business funds.